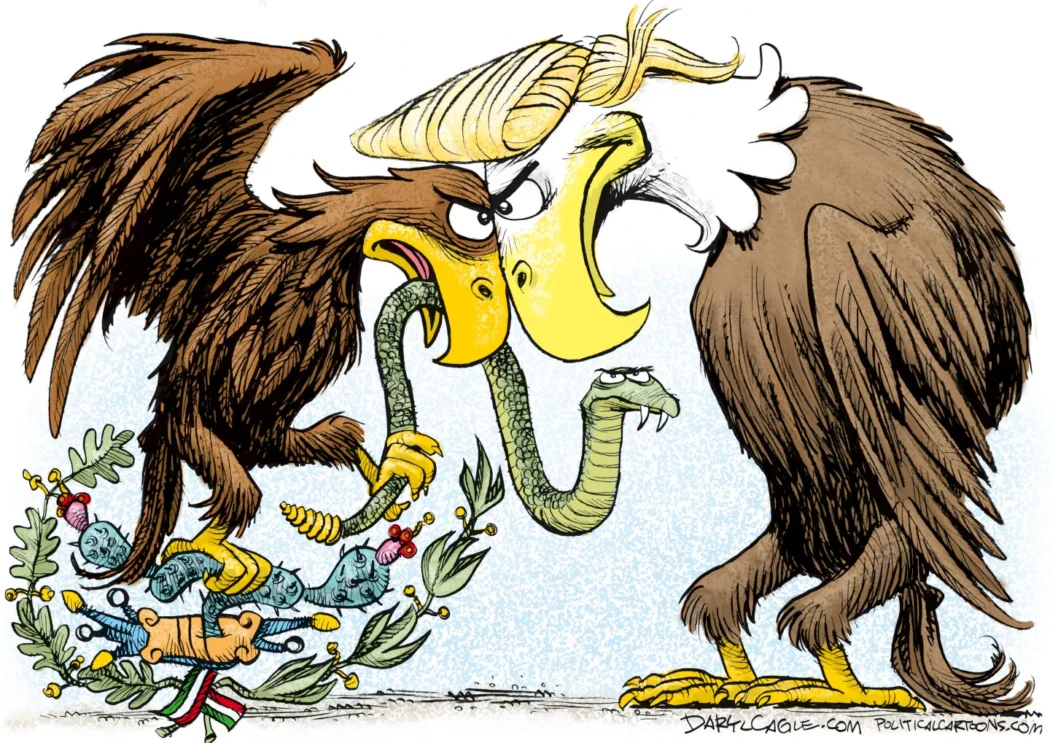

On Feb.1, President Trump implemented a set of tariffs on Canada, Mexico and China in response to rising tensions over fentanyl trafficking and immigration.

On Feb. 3, Mexico announced a series of retaliatory measures that caused the Trump administration to postpone the 25% tariff. Canada declared similar measures and was then granted the same respite later that day

President Trump announced he would halt the import levies on goods from Canada and Mexico for at least one month to allow for negotiation between the countries.

Despite this, tariffs on Chinese imports began at a 10% additional tariff on top of the existing dues currently applied to many Chinese goods.

Understanding Tariffs

A tariff is a tax on imported goods, usually as a percentage of the product’s value. The value of a product is determined by how much an independent buyer would be willing to pay for something from an independent seller.

For example, for an item subject to a 10% tariff, the importer will need to pay an additional $10 for the goods.

Who Pays the Cost?

Under U.S law, the importer is responsible for paying the tariff; however, it is typical for the price on tariffed goods to increase to allow for a larger profit margin for the distributor.

For example, crude oil from Canada that is piped into the US to be refined into gasoline would have a 10% tariff. If priced at $75 a barrel, there would be an additional $7.5 charge to import the oil into the U.S.

Oil has an incredibly small profit margin—this additional charge could lead to higher gas prices for consumers as distributors pass on the extra cost.

“BP is not going to absorb any part of the additional $6 or whatever it is”- David A. Gantz, Will Clayton Fellow in Trade and International Economics at Rice University

Similar to gasoline, items like perishable vegetables may be at risk of price hikes. Items like children’s toys, cosmetics and footwear have high-profit margins that could withstand the additional cost the tariff has in importing the product.

Why Use Them?

Historically, tariffs were used as the primary source of revenue for the federal government until 1913 when federal income tax began.

At their highest, tariffs accounted for approximately 90% of the federal government’s revenue. Once the effects of income tax set in, that percentage fell to 30.1% after the start of the Civil War in 1915.

Tariffs have steadily declined in their contribution toward federal revenue. Over the past 70 years, tariffs have never accounted for more than 2% of revenue. In 2024, their contribution was 1.5% which amounted to about $77 billion in collected duties.

Reciprocal Tariffs

President Trump’s administration has threatened to extend tariffs to other nations to address trade imbalances.

During a Feb.7, meeting with Japanese Prime Minister Shigeru Ishiba, Trump reiterated that reciprocal tariffs would be imposed on various countries soon.

President Trump has remained steadfast in targeting the auto industry as European Union (EU) tariffs on car imports are exceedingly higher than US levies.

Reports indicate that Trump could act on these tariffs “pretty soon” while a potential deal with the UK could alter the trajectory of the EU trade dispute.

The Path Forward

As tensions rise, many question whether the ongoing trade wars will result in meaningful agreements or leave the global economy in a state of perpetual conflict.

Will Trump’s tariff strategy truly “level the playing field” or will it simply exacerbate existing economic challenges?

Let us know your thoughts by tagging us @VALLEYmag on X.

Related

U.S. Under Scrutiny For Treatment of Deportees

Assad Regime Topples in Syria

Trump’s Executive Orders: The Impact on Penn State

of course like your website however you need to test the spelling on quite a few of your posts. Several of them are rife with spelling issues and I in finding it very troublesome to inform the truth on the other hand I will surely come again again.

magnificent post, very informative. I wonder why the other experts of this sector don’t notice this. You must continue your writing. I’m confident, you have a great readers’ base already!

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

It’s in point of fact a nice and helpful piece of information. I am satisfied that you simply shared this useful info with us. Please stay us informed like this. Thank you for sharing.

I am lucky that I detected this web blog, exactly the right info that I was searching for! .

I’d forever want to be update on new articles on this website , saved to favorites! .

Thanks for helping out, good information.

You actually make it appear really easy along with your presentation however I find this matter to be actually something that I believe I might never understand. It kind of feels too complicated and very large for me. I am having a look forward in your subsequent put up, I¦ll attempt to get the grasp of it!

You have noted very interesting details! ps decent web site.

Hi there just wanted to give you a quick heads up. The words in your post seem to be running off the screen in Firefox. I’m not sure if this is a formatting issue or something to do with web browser compatibility but I figured I’d post to let you know. The style and design look great though! Hope you get the problem resolved soon. Thanks