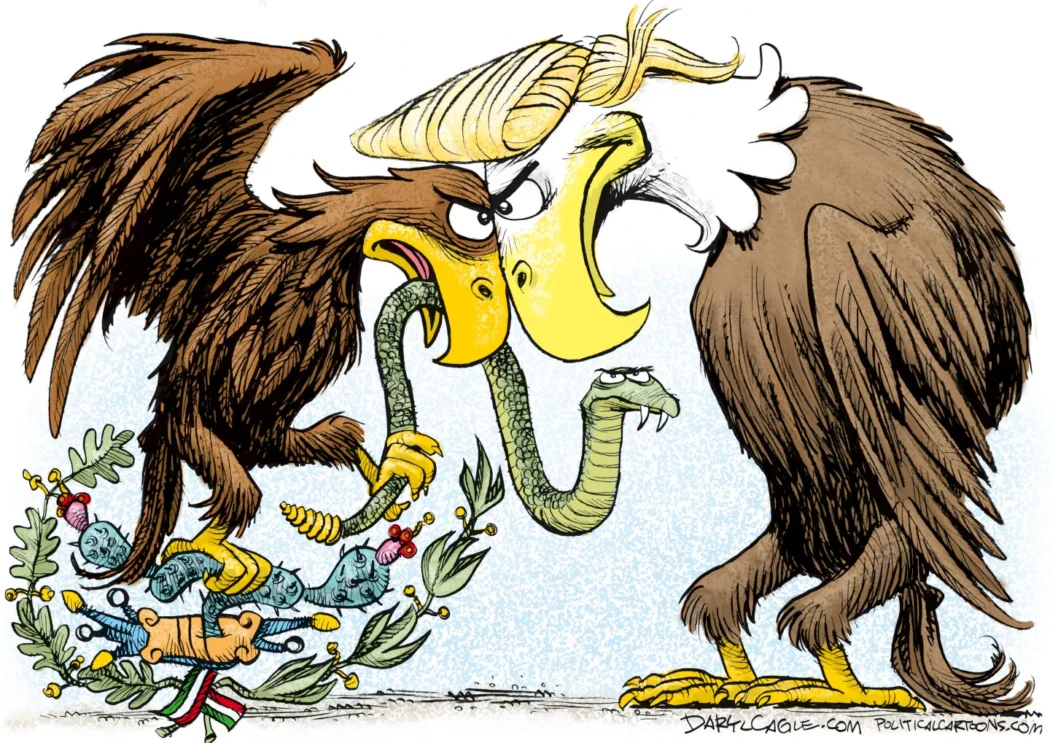

On Feb.1, President Trump implemented a set of tariffs on Canada, Mexico and China in response to rising tensions over fentanyl trafficking and immigration.

On Feb. 3, Mexico announced a series of retaliatory measures that caused the Trump administration to postpone the 25% tariff. Canada declared similar measures and was then granted the same respite later that day

President Trump announced he would halt the import levies on goods from Canada and Mexico for at least one month to allow for negotiation between the countries.

Despite this, tariffs on Chinese imports began at a 10% additional tariff on top of the existing dues currently applied to many Chinese goods.

Understanding Tariffs

A tariff is a tax on imported goods, usually as a percentage of the product’s value. The value of a product is determined by how much an independent buyer would be willing to pay for something from an independent seller.

For example, for an item subject to a 10% tariff, the importer will need to pay an additional $10 for the goods.

Who Pays the Cost?

Under U.S law, the importer is responsible for paying the tariff; however, it is typical for the price on tariffed goods to increase to allow for a larger profit margin for the distributor.

For example, crude oil from Canada that is piped into the US to be refined into gasoline would have a 10% tariff. If priced at $75 a barrel, there would be an additional $7.5 charge to import the oil into the U.S.

Oil has an incredibly small profit margin—this additional charge could lead to higher gas prices for consumers as distributors pass on the extra cost.

“BP is not going to absorb any part of the additional $6 or whatever it is”- David A. Gantz, Will Clayton Fellow in Trade and International Economics at Rice University

Similar to gasoline, items like perishable vegetables may be at risk of price hikes. Items like children’s toys, cosmetics and footwear have high-profit margins that could withstand the additional cost the tariff has in importing the product.

Why Use Them?

Historically, tariffs were used as the primary source of revenue for the federal government until 1913 when federal income tax began.

At their highest, tariffs accounted for approximately 90% of the federal government’s revenue. Once the effects of income tax set in, that percentage fell to 30.1% after the start of the Civil War in 1915.

Tariffs have steadily declined in their contribution toward federal revenue. Over the past 70 years, tariffs have never accounted for more than 2% of revenue. In 2024, their contribution was 1.5% which amounted to about $77 billion in collected duties.

Reciprocal Tariffs

President Trump’s administration has threatened to extend tariffs to other nations to address trade imbalances.

During a Feb.7, meeting with Japanese Prime Minister Shigeru Ishiba, Trump reiterated that reciprocal tariffs would be imposed on various countries soon.

President Trump has remained steadfast in targeting the auto industry as European Union (EU) tariffs on car imports are exceedingly higher than US levies.

Reports indicate that Trump could act on these tariffs “pretty soon” while a potential deal with the UK could alter the trajectory of the EU trade dispute.

The Path Forward

As tensions rise, many question whether the ongoing trade wars will result in meaningful agreements or leave the global economy in a state of perpetual conflict.

Will Trump’s tariff strategy truly “level the playing field” or will it simply exacerbate existing economic challenges?

Let us know your thoughts by tagging us @VALLEYmag on X.

Related

U.S. Under Scrutiny For Treatment of Deportees

Assad Regime Topples in Syria

Trump’s Executive Orders: The Impact on Penn State

I am impressed with this internet site, really I am a fan.

Thanks for the auspicious writeup. It in fact was a entertainment account it. Look complex to far introduced agreeable from you! By the way, how can we keep up a correspondence?

Amazing blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple tweeks would really make my blog jump out. Please let me know where you got your theme. Bless you

I have read a few excellent stuff here. Definitely value bookmarking for revisiting. I wonder how so much effort you put to create this type of fantastic informative web site.

Have you ever thought about creating an ebook or guest authoring on other sites? I have a blog based on the same subjects you discuss and would really like to have you share some stories/information. I know my subscribers would appreciate your work. If you’re even remotely interested, feel free to send me an e-mail.

Thank you for sharing excellent informations. Your web-site is so cool. I’m impressed by the details that you’ve on this website. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found just the info I already searched everywhere and simply could not come across. What a great site.

Can I simply say what a reduction to find someone who actually is aware of what theyre speaking about on the internet. You undoubtedly know how to deliver a problem to gentle and make it important. More individuals need to learn this and perceive this aspect of the story. I cant consider youre not more standard because you undoubtedly have the gift.

I have read some good stuff here. Definitely worth bookmarking for revisiting. I surprise how much effort you put to make such a great informative site.

Sweet site, super design and style, rattling clean and utilize friendly.

hello there and thank you for your information – I’ve certainly picked up anything new from right here. I did however expertise several technical points using this web site, as I experienced to reload the site lots of times previous to I could get it to load properly. I had been wondering if your web host is OK? Not that I’m complaining, but slow loading instances times will often affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Well I am adding this RSS to my email and can look out for much more of your respective fascinating content. Make sure you update this again soon..