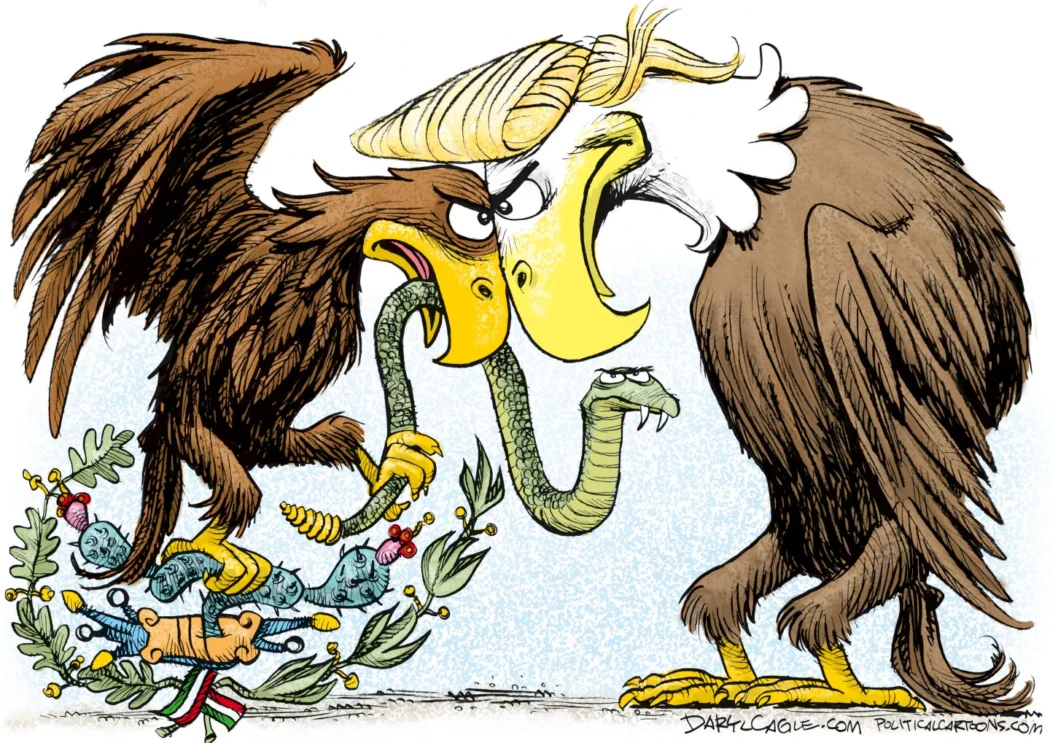

On Feb.1, President Trump implemented a set of tariffs on Canada, Mexico and China in response to rising tensions over fentanyl trafficking and immigration.

On Feb. 3, Mexico announced a series of retaliatory measures that caused the Trump administration to postpone the 25% tariff. Canada declared similar measures and was then granted the same respite later that day

President Trump announced he would halt the import levies on goods from Canada and Mexico for at least one month to allow for negotiation between the countries.

Despite this, tariffs on Chinese imports began at a 10% additional tariff on top of the existing dues currently applied to many Chinese goods.

Understanding Tariffs

A tariff is a tax on imported goods, usually as a percentage of the product’s value. The value of a product is determined by how much an independent buyer would be willing to pay for something from an independent seller.

For example, for an item subject to a 10% tariff, the importer will need to pay an additional $10 for the goods.

Who Pays the Cost?

Under U.S law, the importer is responsible for paying the tariff; however, it is typical for the price on tariffed goods to increase to allow for a larger profit margin for the distributor.

For example, crude oil from Canada that is piped into the US to be refined into gasoline would have a 10% tariff. If priced at $75 a barrel, there would be an additional $7.5 charge to import the oil into the U.S.

Oil has an incredibly small profit margin—this additional charge could lead to higher gas prices for consumers as distributors pass on the extra cost.

“BP is not going to absorb any part of the additional $6 or whatever it is”- David A. Gantz, Will Clayton Fellow in Trade and International Economics at Rice University

Similar to gasoline, items like perishable vegetables may be at risk of price hikes. Items like children’s toys, cosmetics and footwear have high-profit margins that could withstand the additional cost the tariff has in importing the product.

Why Use Them?

Historically, tariffs were used as the primary source of revenue for the federal government until 1913 when federal income tax began.

At their highest, tariffs accounted for approximately 90% of the federal government’s revenue. Once the effects of income tax set in, that percentage fell to 30.1% after the start of the Civil War in 1915.

Tariffs have steadily declined in their contribution toward federal revenue. Over the past 70 years, tariffs have never accounted for more than 2% of revenue. In 2024, their contribution was 1.5% which amounted to about $77 billion in collected duties.

Reciprocal Tariffs

President Trump’s administration has threatened to extend tariffs to other nations to address trade imbalances.

During a Feb.7, meeting with Japanese Prime Minister Shigeru Ishiba, Trump reiterated that reciprocal tariffs would be imposed on various countries soon.

President Trump has remained steadfast in targeting the auto industry as European Union (EU) tariffs on car imports are exceedingly higher than US levies.

Reports indicate that Trump could act on these tariffs “pretty soon” while a potential deal with the UK could alter the trajectory of the EU trade dispute.

The Path Forward

As tensions rise, many question whether the ongoing trade wars will result in meaningful agreements or leave the global economy in a state of perpetual conflict.

Will Trump’s tariff strategy truly “level the playing field” or will it simply exacerbate existing economic challenges?

Let us know your thoughts by tagging us @VALLEYmag on X.

Related

U.S. Under Scrutiny For Treatment of Deportees

Assad Regime Topples in Syria

Trump’s Executive Orders: The Impact on Penn State

As a Newbie, I am always exploring online for articles that can help me. Thank you

excellent post, very informative. I wonder why the other experts of this sector do not notice this. You should continue your writing. I’m confident, you’ve a huge readers’ base already!

Incredible! This blog looks just like my old one! It’s on a completely different subject but it has pretty much the same page layout and design. Outstanding choice of colors!

Helpful information. Lucky me I discovered your site unintentionally, and I am surprised why this coincidence didn’t came about in advance! I bookmarked it.

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

Rattling clear website , thankyou for this post.

I am lucky that I found this site, precisely the right information that I was searching for! .

I’m still learning from you, but I’m trying to achieve my goals. I definitely enjoy reading all that is written on your site.Keep the posts coming. I enjoyed it!

Sugaring effektive und moderne Haarentfernung in Berlin Die Epilation mit Zuckerpaste wird von unseren speziell dafür ausgebildeten Kosmetikerinnen / Depiladoras an allen Körperregionen durchgeführt. Wir bieten diese effektive und moderne Behandlung sehr erfolgreich und schonend mit einem Maximum in der Hygiene der Anwendung an. Sugaring wird immer beliebter.

I?¦ve been exploring for a bit for any high-quality articles or weblog posts in this kind of house . Exploring in Yahoo I at last stumbled upon this site. Studying this info So i am glad to exhibit that I’ve a very good uncanny feeling I found out exactly what I needed. I most for sure will make certain to do not overlook this web site and provides it a look regularly.